Just How Installation Loans Can Simplify Your Budgeting and Financial Preparation

Installation financings give an organized technique to borrowing, making budgeting and monetary planning a lot more workable. With dealt with month-to-month settlements, consumers can expect their expenditures, enabling far better money circulation monitoring. This predictability aids individuals avoid overspending and monetary strain. Comprehending just how to properly incorporate these lendings into a wider financial technique is important. Discovering the nuances of installation car loans can reveal unanticipated benefits and possible difficulties.

Comprehending Installation Loans and Their Benefits

Although many people look for fast monetary services, comprehending installment fundings and their advantages can supply a much more organized approach to loaning. Installation car loans are designed to be paid off in repaired amounts over a fixed duration, commonly including a consistent rates of interest. This predictability allows borrowers to budget properly, as they understand precisely what their monthly repayment will certainly be.

One considerable benefit of installment financings is that they can be used for various objectives, including debt combination, home enhancements, or significant purchases (Cash Advance). Unlike bank card, which may have ever-changing rate of interest and repayments, installment financings provide a more clear payment timeline. Furthermore, prompt settlements can improve a customer's credit rating, more enhancing their monetary standing. With liable use, installment loans can work as a valuable device for individuals seeking to handle their funds without resorting to unpredictable and high-interest borrowing options

Just How Installation Loans Suit Your Spending plan

Installment financings can play a substantial duty in reliable budgeting by offering consumers with a clear payment structure. Unlike rotating credit report options, installment lendings require set month-to-month payments over a fixed period. This predictability allows people to allocate their finances more successfully, as they can prepare for the precise amount due monthly.

Additionally, debtors can include these fixed repayments into their budgets, ensuring that they do not exceed their monetary limitations. This organized technique help in preventing overspending and assists preserve financial technique. Furthermore, the lump-sum nature of the finance can allow people to make larger acquisitions or financial investments without straining their instant capital. By understanding the total price of the car loan, consisting of passion, debtors can make informed decisions that straighten with their long-lasting financial goals. Generally, installation car loans can enhance economic planning by advertising a disciplined approach to financial obligation administration.

Kinds of Installment Loans Available

When taking into consideration funding options, people can select from different sorts of installation fundings customized to fulfill different needs. Individual fundings are amongst one of the most common, providing flexibility for numerous expenses like home renovations or medical costs. Car financings specifically target vehicle acquisitions, permitting consumers to finance their cars while spreading out repayments in time. Home mortgages are bigger installation fundings dedicated to realty acquisitions, commonly covering numerous decades.

.png)

The Application Process for Installation Loans

Just how does one browse the application procedure for installment car loans? The process generally starts with choosing a loan provider that provides positive terms. Borrowers ought to gather necessary paperwork, which usually consists of proof of debt, income, and identification background. This info assists lending institutions evaluate the applicant's financial security and credit reliability.

Next, possible debtors finish an application form, which can usually be done online for benefit (Cash Loans). Lenders might need extra details throughout this stage, such as details on existing financial obligations. As soon as sent, the lender assesses the application, reviewing aspects like credit history and earnings degrees

After authorization, customers obtain loan terms, including rate of interest and settlement timetables. It is important for applicants to carefully review these terms prior to approving the car loan. Ultimately, once the agreement is authorized, funds are typically paid out rapidly, enabling customers to access the cash they require for their financial objectives.

Managing Regular Monthly Settlements Effectively

Taking care of regular monthly repayments efficiently is crucial for preserving economic security. A foreseeable settlement routine allows debtors to integrate these dealt with expenditures into their budgets seamlessly. By focusing on these repayments, people can ensure they fulfill their economic dedications without compromising various other essential requirements.

Predictable Settlement Arrange

Developing a foreseeable settlement schedule is necessary for individuals looking for to handle their monthly funds effectively. Installment car loans provide a clear structure, allowing debtors to expect their payment quantities and due dates. This predictability aids people allot funds much more effectively, permitting better planning and reduced monetary anxiety. Knowing precisely just how much will be owed every month help in avoiding shocks, making it easier to focus on expenses and financial savings. Furthermore, a constant settlement schedule cultivates discipline in financial behaviors, as borrowers develop a more helpful hints regular around their settlements. Eventually, this clarity empowers people to take control of their financial scenario, ensuring they continue to be on the right track with their general budgeting goals while successfully handling their money circulation.

Budgeting for Fixed Costs

While guiding with the complexities of individual money, people often locate that budgeting for dealt with expenditures is crucial for keeping economic stability. Fixed costs, such as lease or mortgage repayments, energies, and funding installments, call for mindful planning to assure they fit within a monthly spending plan. By classifying these expenditures, individuals can allocate a certain section of their income in the direction of them, developing a foreseeable monetary framework. Making use of tools like spread sheets or budgeting applications can boost this process, permitting real-time tracking of costs. Additionally, developing an emergency situation fund can give a barrier versus unforeseen official statement expenses, ensuring repaired expenses stay workable. Ultimately, effective budgeting for taken care of costs fosters a feeling of control and confidence in one's economic trip.

Avoiding Usual Pitfalls With Installment Loans

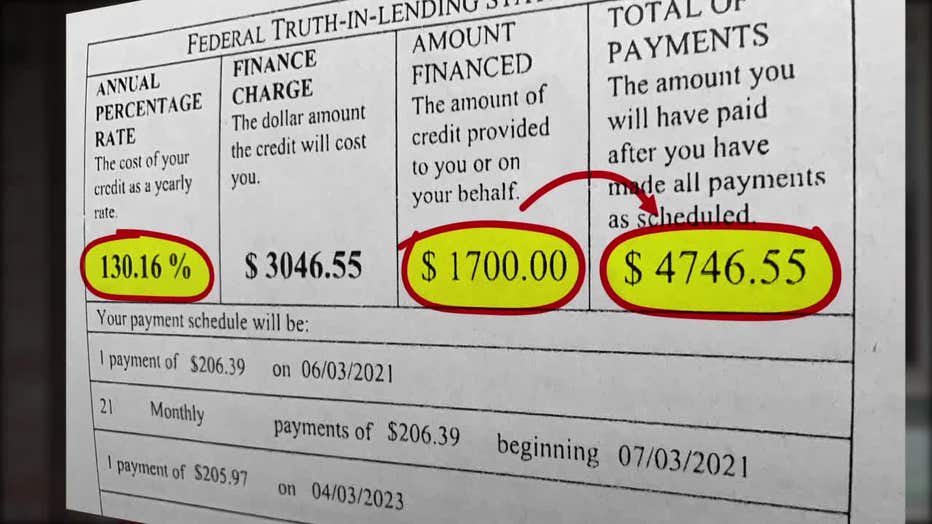

Steering the landscape of installation finances requires mindful factor to consider to avoid usual challenges that can cause financial pressure. One considerable risk is ignoring the overall cost of the financing, including rate of interest and costs, which can inflate regular monthly payments. Consumers should additionally watch out for taking on loans that surpass their settlement capacity, as this can develop a cycle of financial obligation. It is important to check out the finance terms completely to recognize the implications of late settlements or defaults, as these can result in surcharges or damage to credit history. In addition, spontaneous loaning without a clear strategy can hinder budgeting efforts. To alleviate these threats, people ought to evaluate their economic circumstance realistically, compare different financing options, and make certain they have a repayment technique in area. By doing so, borrowers can make informed decisions that straighten with their lasting financial objectives.

Real-Life Scenarios: When to Take Into Consideration an Installation Car Loan

In specific scenarios, such as financing home restorations or covering unforeseen clinical expenses, people might discover installment lendings to be a practical choice. These finances can supply the needed funds to manage considerable costs while permitting workable repayment terms. Comprehending when to use installment car loans can aid individuals make educated economic choices.

Home Improvement Funding

Home restorations typically stand for a considerable financial investment, prompting lots of homeowners to check out various financing choices. An installment car loan can be a reliable our website choice for those looking to enhance their home without stressing their financial resources. For instance, a family members might desire to redesign their kitchen to boost functionality and increase home worth. By going with an installation funding, they can manage monthly settlements while staying clear of the concern of a big in advance cost. A couple could seek to complete their basement, producing added living room for their expanding family. In both situations, installation lendings can provide the necessary funds, permitting homeowners to achieve their restoration objectives while preserving a well balanced spending plan and ensuring monetary stability.

Emergency Medical Expenses

Unforeseen clinical expenditures can develop at any kind of minute, leaving people and families in financial distress. In such situations, an installment lending may provide a practical option. Take into consideration a circumstance where a household member needs emergency situation surgical procedure. The instant expenses can be frustrating, and wellness insurance policy may not cover all costs. An installment car loan allows the family members to handle the costs in time, making it simpler to budget month-to-month settlements instead of encountering a substantial round figure. Likewise, if a sudden illness requires extensive treatment, an installation loan can ease instant monetary pressure, offering tranquility of mind. This structured settlement plan assists people preserve their monetary security while attending to urgent clinical demands properly.

Often Asked Concerns

Can I Pay off an Installation Car Loan Early Without Penalties?

Many installment fundings allow very early repayment without charges, but terms differ by loan provider. Borrowers should examine their lending contracts or talk to their lenders to confirm any potential costs linked with very early payoff.

Exactly how Does My Credit History Rating Influence Installment Financing Authorization?

A credit rating rating substantially impacts installation finance authorization. Lenders analyze scores to establish creditworthiness; higher scores typically result in much better authorization opportunities and positive terms, while lower ratings may result in rejection or higher rate of interest.

What Takes place if I Miss an Installation Payment?

If a private misses an installment repayment, late costs might sustain, their credit scores rating might decline, and the lending institution may start collection activities. Regular missed payments can bring about lending default and potential legal consequences.

Are Installment Loans Available for Bad Credit Scores Customers?

Yes, installment lendings are available for debtors with bad credit scores. Lenders may supply these loans, but terms frequently consist of greater rates of interest and more rigorous settlement problems, showing the increased risk associated with lower credit report.

Can I Combine Several Installation Loans Into One?

Yes, people can settle numerous installation finances into one funding, streamlining month-to-month settlements and potentially lowering rates of interest. This process can enhance monetary administration, making it simpler to track and settle debts effectively.

Installment loans supply a structured method to loaning, making budgeting and financial planning a lot more convenient. Several individuals seek quick monetary options, comprehending installment fundings and their benefits can provide a much more organized method to borrowing. Furthermore, there are specialized fundings such as holiday financings or wedding event lendings, which provide to particular life occasions. Each kind of installment car loan comes with its distinct terms, interest prices, and payment schedules, permitting individuals to select a choice that straightens with their economic circumstance and goals. Yes, individuals can settle multiple installation financings right into one financing, simplifying regular monthly payments and potentially reducing rate of interest rates.